nassau county property tax rate 2020

Find All The Record Information You Need Here. Ad Easily File Your Rental Property Taxes.

Map Bay Area Property Taxes Kron4

You Report Revenue We Do The Rest.

. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Nassau County collects on average 074 of a propertys. COVID-19 Nassau County property taxes 145 pm Mon April 20 2020 Long Island Business.

What is the property tax rate in Nassau County NY. Nassau County collects on average 179 of a propertys. 1 discount if paid in the month of.

2 discount if paid in the month of January. 3 discount if paid in the month of December. Ad Easily File Your Rental Property Taxes.

For six straight years before FY 2019-20 the tax rate was. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The median Nassau County tax bill was 14872 in 2019.

County Nassau County Department of Assessment 516 571. Unsure Of The Value Of Your Property. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

The median property tax in Nassau County New York is 8711 per year for a home. You Report Revenue We Do The Rest. Schedule a Physical Inspection of Your Property.

If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter. Nassau County has one of the. In other words the price of living in Nassau County will be much higher on average when taxes come.

Access property records Access real properties. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your. Ad Get Record Information From 2022 About Any County Property.

The new property tax rate will be 072212 per 100 valuation which is lower than the existing rate of 073212. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. Nassau County Annual Tax Lien Sale - 2023.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. On February 21 st 2023 the Nassau County Treasurer will sell at public on-line auction the tax liens on certain real estate unless the. Difference in Millage 2019 to 2020 03203 10989 01553 01847 01928 01847 01928 01989 Percent Change from Prior Year Millage 195 533 097 114 118 114.

4 discount if paid in the month of November. The plan would phase in any increase to your propertys value with 20 of the. Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021 plus town.

Nassau County has one of the highest median property taxes in the United. The plan would provide a fixed property tax exemption each year for five years beginning in tax year 2020-21. In Nassau County the median property tax bill is 14872 according to state sources.

However some school districts use different tax rates for different property classes. In most school districts the tax rates are the same for all property.

Westchester County Ny Property Tax Search And Records Propertyshark

Chemung County Ny Property Tax Search And Records Propertyshark

Riverside County Ca Property Tax Search And Records Propertyshark

New York Property Tax Calculator Smartasset

How To Lower Property Taxes 7 Tips Quicken Loans

Map Bay Area Property Taxes Kron4

These Are America S 10 Most Expensive States To Live In For 2021

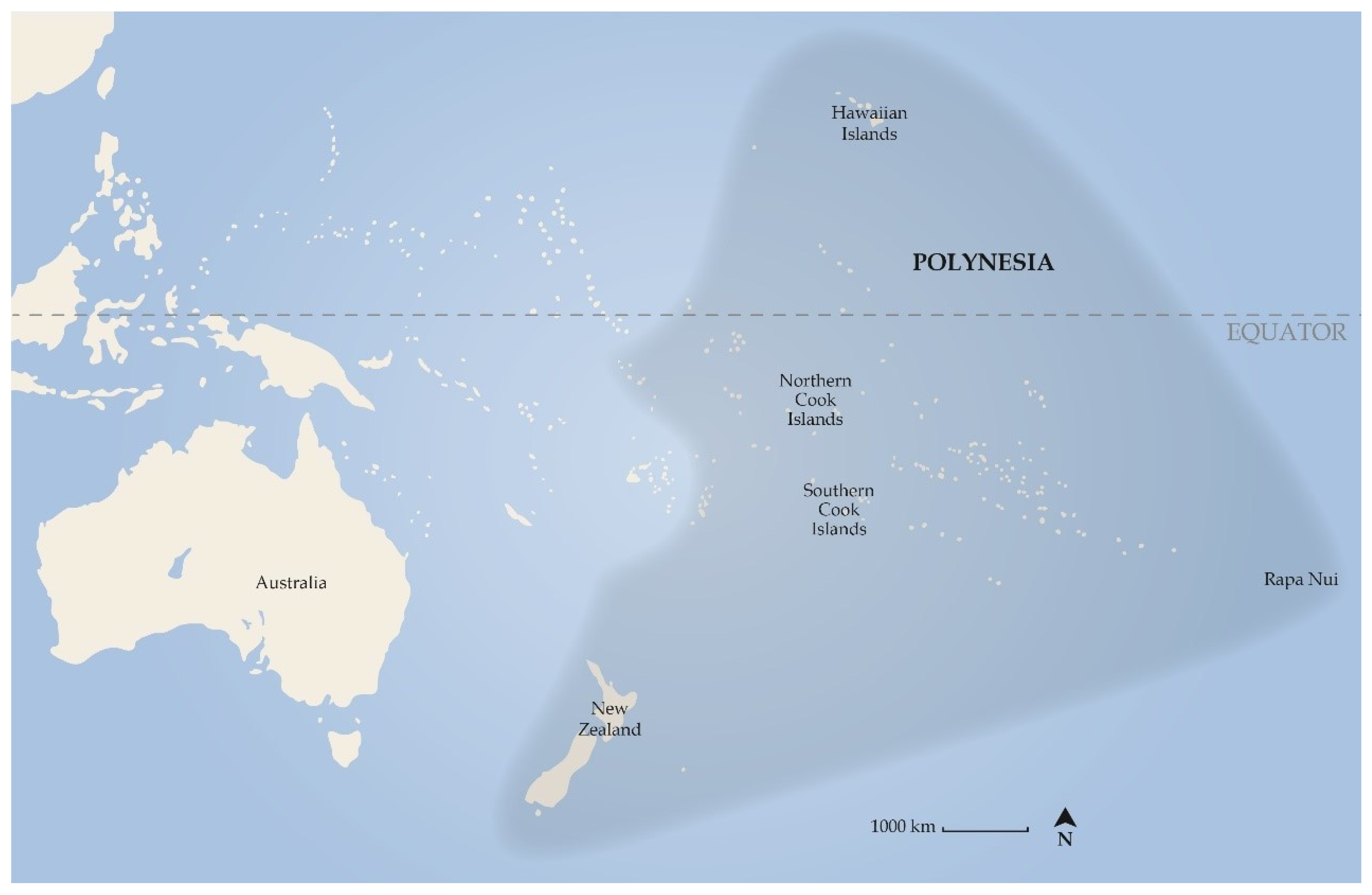

Sustainability Free Full Text Dynamic Sustainability Resource Management And Collective Action On Two Atolls In The Remote Pacific Html

New York Property Tax Calculator Smartasset

New York Property Tax Calculator Smartasset

Your Guide To Prorated Taxes In A Real Estate Transaction

The School Tax Relief Star Program Faq Ny State Senate

Australia Property Investment Mernda On The Park

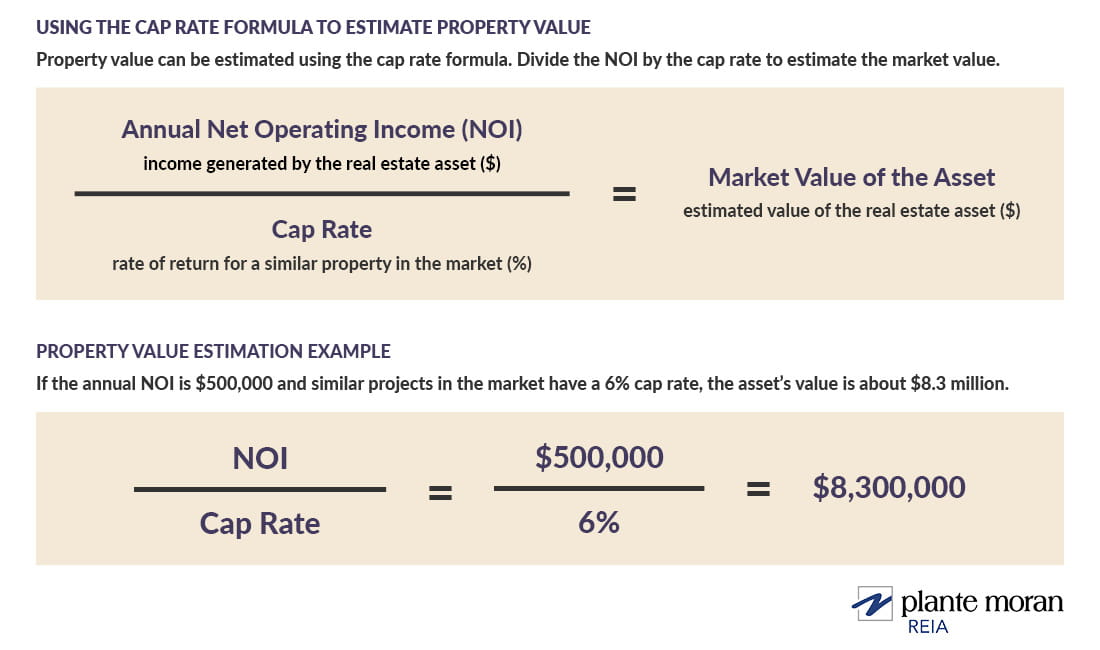

Return Metrics Explained What Is A Cap Rate In Commercial Real Estate Our Insights Plante Moran

Map Bay Area Property Taxes Kron4

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

Foreclosure Retention Options Lawyer For Keeping Long Island Ny Property Long Island Bankruptcy Foreclosure Law Firm

_Web.jpg)